steel market update price index commodity steel billets and slabs + Simurgh Steel Industrial Complex News magazine Number 118

The studies of steel market update price index Simurgh Steel Industrial Complex + News magazine Number 118 can help to make decisions in our future transactions.

Steel market update price

The price difference of all types of steel in the Iran Commodity Exchange can be seen in the table above with global prices in NIMA dollars:

Steel ingot Commodity exchange prices are lower than world prices, but compared to FOB price of Iran, it is 8%+ more expensive and the market should be balanced by increasing supply and applying the 3%+ formula of Commodity Exchange in weekly transactions.

The hot sheet is witnessing a huge price difference between international prices and domestic prices.

Price of steel commodity

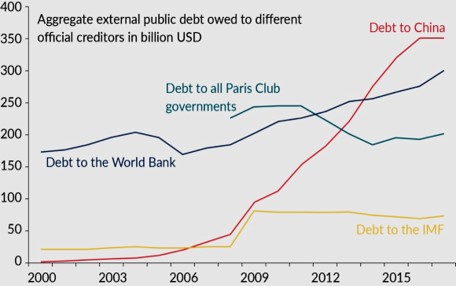

Macroeconomy: The rising finance of developing countries by China is troublesome.

For the information of respected members, China is the largest financier of developing countries… the debt figure reached 350 billion dollars last year and is higher than the World Bank, the Paris Club and the International Monetary Fund.

For years, the Chinese have been marketing their products by providing finance to customers and concluding large infrastructure and industrial contracts.

Now, with the growth of the dollar and its interest and the drop in the income of the countries, the return of these money is in doubt, which will have a negative.

impact not only on the developing countries, but also on the Chinese economy. Commodity In recent days, many reports have been published in this regard by European and American analysts, however, the market is still waiting for real signs of this crisis to analyze its effects on commodities and other areas.

Commodity price index

Russia & Energy

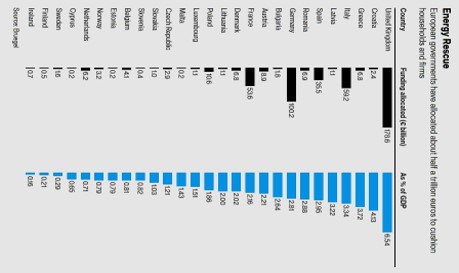

500 billion euro energy subsidy in European countries!

Sanctions against #Russia have stimulated energy prices in Europe and social unrest in this continent… European governments have forced to inject money and energy subsidies to families and promised stability of electricity and gas prices.

This promise of politicians will not be without cost for the economies of countries Estimates show the energy subsidy figure of 500 billion dollars/euro in this continent… England with a subsidy of 178.6 billion euros or dollars… which is equivalent to 6.54% of that country’s GDP. pays the most subsidies to families in order to stabilize energy prices

Germany also ranks next with 100.2 billion euros and #France with 53.6 billion euros.

Steel billets price

Slab of Iran is looking forward to the lifting of sanctions!

Iran’s large steel companies’ exports improved for billets and sanctions were lifted for slabs.

Iran’s steel billet exports are improving. Some factories have had an export growth of +154% in the last month for the export of steel ingots, and in total this year there is an increase of +16%.

Unlike billet, the Russians are Iran’s main competitor in slabs in the world markets, and by strongly dumping the market, they have reduced the FOB price of Iran to $440/ton and replaced the European markets with Asian ones… the intensity of the competition is such that the producers Iran’s slabs are practically directed from export markets to domestic markets.

The main reason for the 52% drop in Iran’s steel exports in August is due to the decrease in slab exports.

The issue of coordination with Russia in the steel export of that country, especially in the slab sector and avoiding negative competition with Iran, is being pursued by the government.

Abolition of sanctions can open large European slab markets with more favorable prices for Iranian steelmakers and replace Iranian steelmakers with Russia in Europe.

Simurgh Steel Industrial Complex + News magazine Number 118

The weekly newspaper of Simurgh Mining Industry Association of Azerbaijan about commodities is collected on this site for the studies of activists in these fields. You can definitely make better decisions about your business with these studies and knowledge. The daily prices of the products are also updated every week.

You can contact us to buy and sell this product:

Sales consultant: Ms. Leila Nematzadeh

Ways of communication: Phone number: 02147623014

Phone number: 02147623014

Phone number: 04133660491

Phone number: 04133660491

Phone number: 09120169267

Phone number: 09120169267

WhatsApp Response (Skype): click

WhatsApp Response (Skype): click

Instagram: simurgh_steel_company@

Instagram: simurgh_steel_company@

email: info@simurghsteelco.com

email: info@simurghsteelco.com

email: ironore110@gmail.com

email: ironore110@gmail.com

Facebook: ironore110@

Facebook: ironore110@

LinkedIn: simurgh-iron-and-steel-company-a68295180@

LinkedIn: simurgh-iron-and-steel-company-a68295180@

twitter: CoSimurgh@

twitter: CoSimurgh@

Call number:

Call number:  Whats app:

Whats app:  Address: Salimi industrial Park, Tabriz, IRI

Address: Salimi industrial Park, Tabriz, IRI Instagram:

Instagram:  email:

email:  Facebook:

Facebook: