lme steel billet price today and cu cathode

LME steel billet price today and cu cathode and aluminium billet and zinc in commodity prices + bitumen 60/70 price in Iran, Simurgh Industrial and mining Complex magazine No 120.

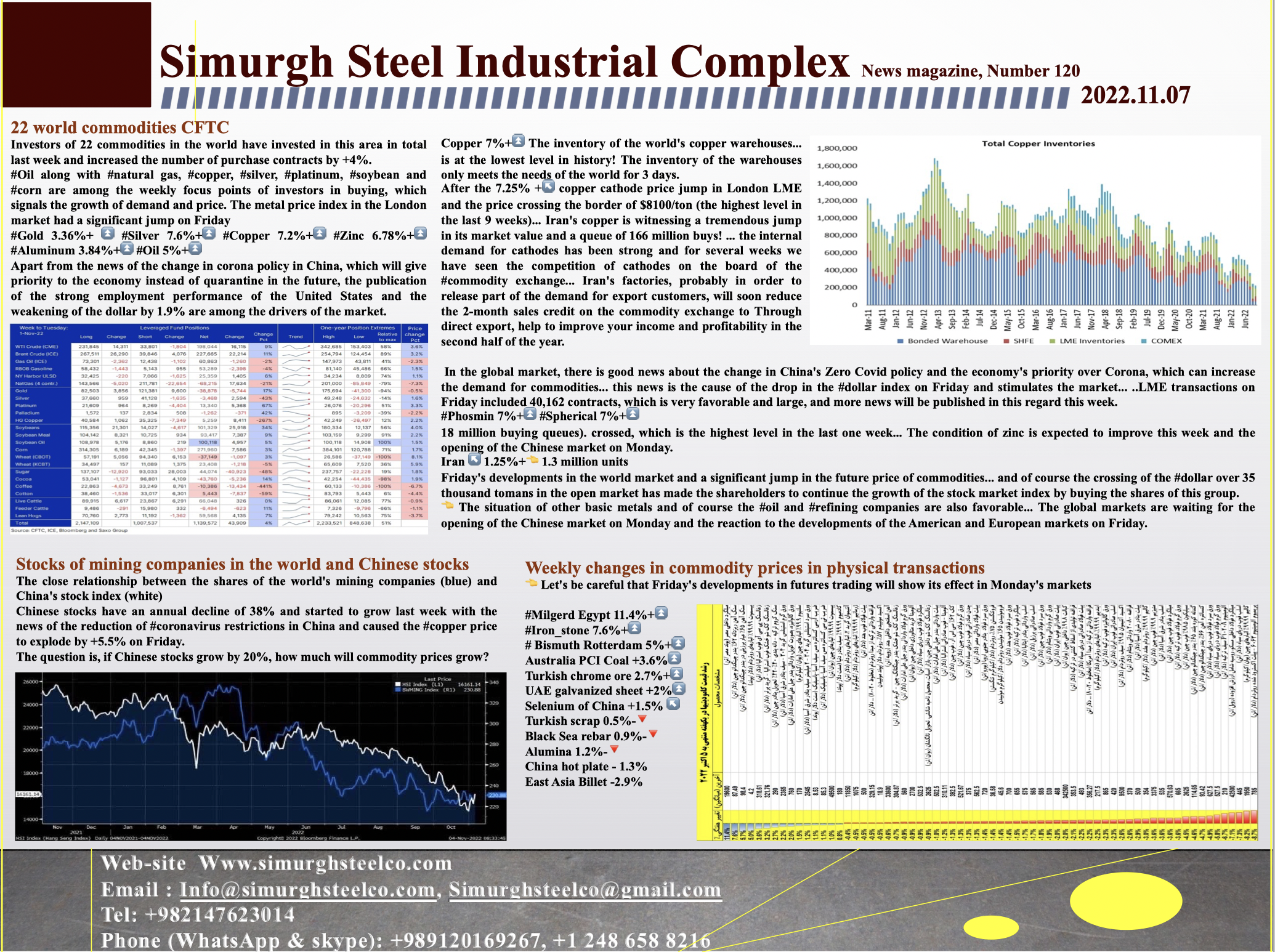

Investors of 22 commodities in the world have invested in this area in total last week and increased the number of purchase contracts by +4%.

22 world commodities CFTC

Oil along with natural gas, copper, silver, platinum, soybean and corn are among the weekly focus points of investors in buying, which signals the growth of demand and price. The metal price index in the London market had a significant jump on Friday

- Gold 3.36%+

- Silver 7.6%+

- Copper 7.2%+

- Zinc 6.78%+

- Aluminum 3.84%+

- Oil 5%+

Apart from the news of the change in corona policy in China, which will give priority to the economy instead of quarantine in the future, the publication of the strong employment performance of the United States and the weakening of the dollar by 1.9% are among the drivers of the market.

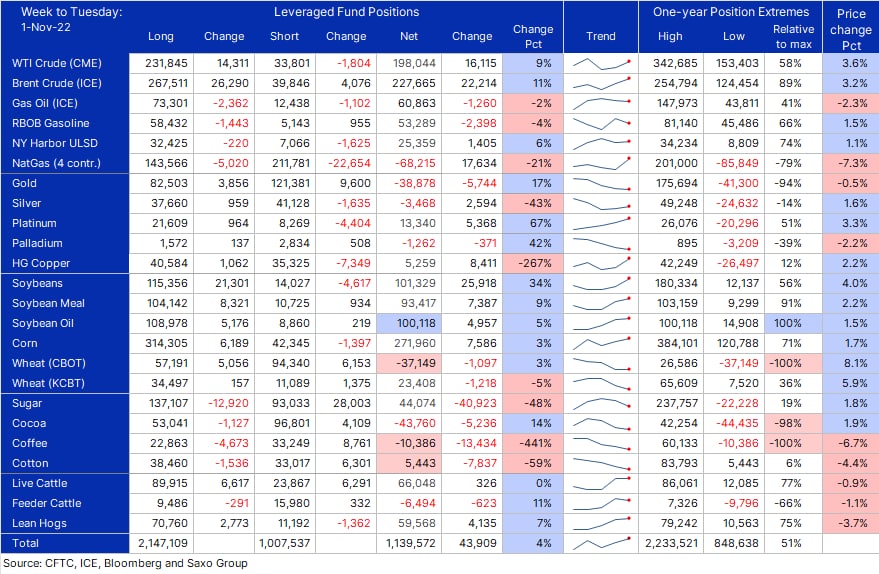

Cu cathode price today

Copper 7%+ The inventory of the world’s copper warehouses, is at the lowest level in history! The inventory of the warehouses only meets the needs of the world for 3 days.

After the 7.25% + copper cathode price jump in London LME and the price crossing the border of $8100/ton (the highest level in the last 9 weeks). Iran’s copper is witnessing a tremendous jump in its market value and a queue of 166 million buys! the internal demand for cathodes has been strong and for several weeks we have seen the competition of cathodes on the board of the #commodity exchange… Iran’s factories, probably in order to release part of the demand for export customers, will soon reduce the 2-month sales credit on the commodity exchange to Through direct export, help to improve your income and profitability in the second half of the year.

Zinc ingots for sale

Zinc production companies are also benefiting from the positive news of China and witnessing the growth of the value to the daily limit (the total of two symbols is 18 million buying queues). crossed, which is the highest level in the last one week. The condition of zinc is expected to improve this week and the opening of the Chinese market on Monday.

In the global market, there is good news about the change in China’s Zero Covid policy and the economy’s priority over Corona, which can increase the demand for commodities. this news is the cause of the drop in the dollar index on Friday and stimulates the market. LME transactions on Friday included 40,162 contracts, which is very favorable and large, and more news will be published in this regard this week.

lme steel billet price today

Iran 1.25%+ 1.3 million units

Friday’s developments in the world market and a significant jump in the future price of commodities, and of course the crossing of the dollar over 35 thousand tomans in the open market has made the shareholders to continue the growth of the stock market index by buying the shares of this group.

The situation of other basic metals and of course the oil and refining companies are also favorable, The global markets are waiting for the opening of the Chinese market on Monday and the reaction to the developments of the American and European markets on Friday.

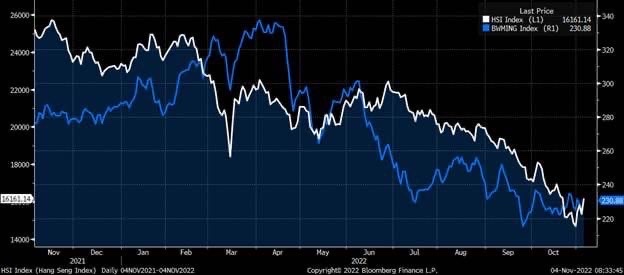

Weekly changes in commodity prices in physical transactions

Let’s be careful that Friday’s developments in futures trading will show its effect in Monday’s markets

- Steel rebars Egypt 11.4%+

- Iron stone 7.6%+

- Bismuth Rotterdam 5%+

- Australia PCI Coal +3.6%

- Turkish chrome ore 2.7%+

- UAE galvanized sheet +2%

- Selenium of China +1.5%

- Turkish scrap 0.5%-

- Black Sea rebar 0.9%-

- Alumina 1.2%-

- China hot plate – 1.3%

- East Asia Billet -2.9%

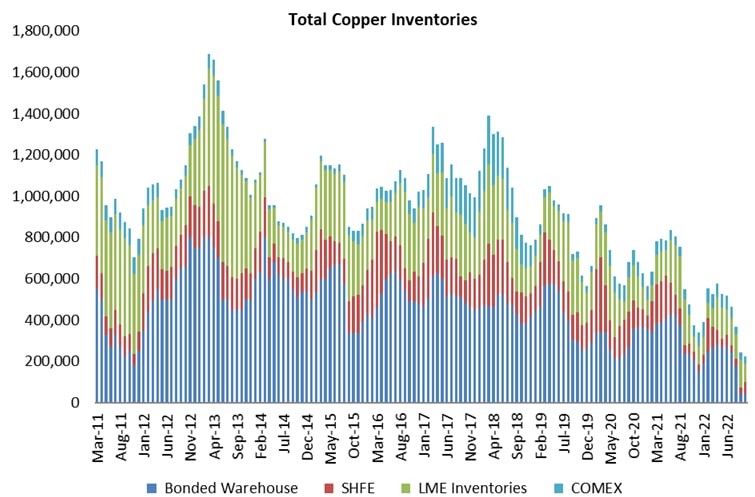

Stocks of mining companies in the world and Chinese stocks

The close relationship between the shares of the world’s mining companies (blue) and China’s stock index (white)

Chinese stocks have an annual decline of 38% and started to grow last week with the news of the reduction of coronavirus restrictions in China and caused the #copper price to explode by +5.5% on Friday.

The question is, if Chinese stocks grow by 20%, how much will commodity prices grow?

Bitumen 60/70 price in Iran

Russian oil, the complete embargo on Russian oil by Europe will start in about 4 weeks, and the idea of setting the price ceiling for Russian oil by the Group of 7 is being completed.

Some additional information:

1- Companies operating in America, England and Europe are not allowed to import Russian oil

2- The price ceiling is related to Russian oil customers in other countries

3- The refineries that buy Russian oil through this model can sell the oil product at the market price domestically or abroad.

4- Traders who buy Russian oil at the allowed price ceiling are allowed to resell it at a free price in their country, but they cannot sell it at a free price in the world market.

The price ceiling for the purchase of Russian oil has not yet been announced by the Group of 7. London insurance companies have announced that they will cancel insurance coverage for ships that do not comply with the Group of 7 regulations.

Simurgh Industrial Complex magazine No 120 date 7 Nov 2022

The weekly publication of the Simurgh industrial and mineral weekly newspaper with the aim of reviewing and informing our customers about all commodity products started from 2022 and is available to our customers weekly through the website www.simurghsteelco.com and also through the network. social is placed. It is worth mentioning the update of the sales prices of the products of this complex, which includes the iron and steel industry, including billets, slabs and blooms, hot and cold steel sheets, rebar, iron ore, sponge iron and iron pellets under the Simorgh brand, and copper and aluminum products and Bitumen under the brand of Artan Industrial Group, which is a subsidiary of this mining industrial complex, is sold weekly for export customers and announced for the domestic market through the stock exchange.

The last price announcement for the month of November was in the form of the following tables:

| Products | Price USD per tone FOB on bulk carrier (For CFR price please contact us) |

MOQ (Tones) | |

| Slabs | 458 | 35,000 | |

| Billets | 3sp – 4SP – 5sp | 466 | 35,000 |

| St34 | 498 | 35,000 | |

| St60 | 471 | 35,000 | |

| 70Cr | 560 | 35,000 | |

| 1sp | 473 | 35,000 | |

| Ck45 | 507 | 35,000 | |

| Ck60 | 529 | 35,000 | |

| SG2 | 628 | 35,000 | |

| C68D2 | 575 | ||

| C72D2 | 575 | ||

| Blooms | 466 | 35,000 | |

| Billets – short length | 461 | 6,000 | |

To receive the updated prices of the day, proceed through the communication channels registered on the contact page.

You can contact us to buy and sell this product:

Sales consultant: Ms. Leila Nematzadeh

Ways of communication: Phone number: 02147623014

Phone number: 02147623014

Phone number: 04133660491

Phone number: 04133660491

Phone number: 09120169267

Phone number: 09120169267

WhatsApp Response (Skype): click

WhatsApp Response (Skype): click

Instagram: simurgh_steel_company@

Instagram: simurgh_steel_company@

email: info@simurghsteelco.com

email: info@simurghsteelco.com

email: ironore110@gmail.com

email: ironore110@gmail.com

Facebook: ironore110@

Facebook: ironore110@

LinkedIn: simurgh-iron-and-steel-company-a68295180@

LinkedIn: simurgh-iron-and-steel-company-a68295180@

twitter: CoSimurgh@

twitter: CoSimurgh@

Call number:

Call number:  Whats app:

Whats app:  Address: Salimi industrial Park, Tabriz, IRI

Address: Salimi industrial Park, Tabriz, IRI Instagram:

Instagram:  email:

email:  Facebook:

Facebook: