Iron ore affordable prices in 2020

iron ore affordable prices in 2020 It is possible directly and online.. The behavior of the Iranian economy is a function of various real and psychological factors; From sanctions, inflation and liquidity to the corona and other environmental factors, it is a difficult question what the overall direction and outcome of these factors will be. But it seems that according to the available evidence, by the end of the year, the coin and gold market (due to the wide increase in ounce prices) will continue to increase, and the foreign exchange market will continue to increase in terms of less foreign exchange inflows across borders. In the commodity markets, on the other hand, in terms of foreign exchange market pressure, inflation is high, but in terms of a serious reduction in people’s purchasing power, the volume of transactions is reduced and the scope of the recession is wider.

How is iron ore converted into steel?

Crude iron is produced by the reduction and smelting of concentrated ore in steel mills. Iron is the second most abundant metal in the earth’s crust after aluminum. The tendency of iron to combine with oxygen is very high and therefore the element iron is not found in nature. The discovery of the first iron structure in Egypt and Mesopotamia introduced the people of that land as the first discoverers of iron. Iron was originally a precious metal and was even more expensive than gold.

Crude iron is produced by the reduction and smelting of concentrated ore in steel mills. Iron is the second most abundant metal in the earth’s crust after aluminum. The tendency of iron to combine with oxygen is very high and therefore the element iron is not found in nature. The discovery of the first iron structure in Egypt and Mesopotamia introduced the people of that land as the first discoverers of iron. Iron was originally a precious metal and was even more expensive than gold.

Unlike gold and copper, due to different geographical conditions, not all the inhabitants of the planet were able to discover iron all the time, and the American continent was the last place in the world to discover iron with the migration of Europeans to that region. Of course, it should be noted that the rich copper resources in the United States made the inhabitants of that region needless to discover new metal. As crude iron production increased, so did its price. This caused iron to be removed from the precious metals group. With the decline in the price of iron production and the problem of tin supply, crude iron was used to produce tools and weapons of war.

Iron meteorite, which is mainly composed of iron and nickel alloys, was used in the construction of early metal structures. Due to its scarcity and high cost, the production of iron tools was costly. Over time, humans have come to realize that by overheating ore with coal, it can produce crude iron. Following this incident and the use of open furnaces, humans took important steps in the production of crude iron.

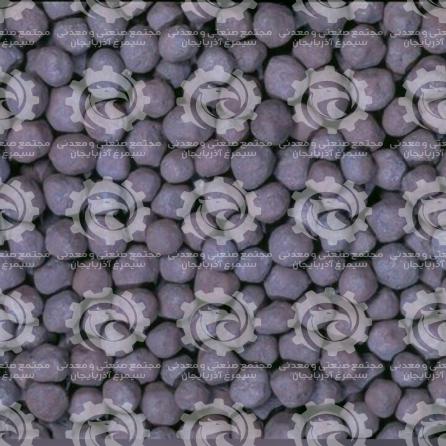

Iron is an important metal for developed countries. Iron ore formation takes many years. The shape of iron ores extracted from different mines is different. A variety of iron oxide, carbonate, sulfide and silicate minerals are found in nature. The major ores from which crude iron is extracted include iron oxides such as magnetite and hematite with 2 to 20% impurities including silicate and aluminate. Impurities with iron ore are separated from the raw iron as slag in the furnace. The extracted iron ore, after refining and concentrating, enters the furnace in the form of powder or fine grains in the size of 6 to 25 mm to prepare the raw iron melt.

The most important minerals used in the production of crude iron are magnetite and hematite. Formulated magnetite and formulated hematite are composed of 72% and 70% iron, respectively. The appropriate size of iron ore granulation for use in blast furnaces is at least 10 mm.

Iron ore extraction

Extraction of iron ore from the mine includes four stages of drilling, blasting, loading and loading. Drill wagons with a diameter of 10 to 25 cm and a depth of 6 to 20 meters are used in drilling mines. Explosives such as emulsions and emulsions are used to blow ore and crush iron ore. A mixture of ammonium nitrate and gasoline is called anfo.

Although ammonium nitrate is an explosive in itself, it is added to oil, gasoline, or diesel because of its low sensitivity to it. Emulsion is also an explosive composed of soluble salts and oxidants such as nitrate, ammonium. For loading iron ore, industrial machines such as shovels or excavators with a loading capacity of 2 to 10 cubic meters are used. Finally, the crushed iron ore is transported to the factory using mining trucks with a capacity of 100 tons.

Rational price for Iron ore in 2020

Iron ore prices should be “lower” next year, while coal prices may go up and steel prices will average and remain stable. He said that the average price of iron ore with 62% of iron delivered to China should decrease by $ 80 per ton in 2019 and should reach $ 94 per ton in 2020 (before 2021 and 2022). Up to $ 60 per tonne). Meanwhile, the average price reduction of this product in 2018 was $ 69 per ton. “Iron ore in 2019 led to a ‘major decline’ in shipments in 2019 due to production disruptions in Vale, Brazil. Now, the industry is ‘mostly on the way back,'” Vale said. Following the January floods, production lost its momentum, rising from 90 million tonnes of iron ore production last year to 30 million or 40 million tonnes this year, he said. The weather may still continue.

Iron ore prices should be “lower” next year, while coal prices may go up and steel prices will average and remain stable. He said that the average price of iron ore with 62% of iron delivered to China should decrease by $ 80 per ton in 2019 and should reach $ 94 per ton in 2020 (before 2021 and 2022). Up to $ 60 per tonne). Meanwhile, the average price reduction of this product in 2018 was $ 69 per ton. “Iron ore in 2019 led to a ‘major decline’ in shipments in 2019 due to production disruptions in Vale, Brazil. Now, the industry is ‘mostly on the way back,'” Vale said. Following the January floods, production lost its momentum, rising from 90 million tonnes of iron ore production last year to 30 million or 40 million tonnes this year, he said. The weather may still continue.

“The current trend is for prices to fall gradually, but the path will be really tortuous,” the analyst said. He said that the production of iron ore and pellets is under pressure due to insufficient supply and weak profit margins in the production sector, and the price difference between 65%, 62% and 58% of iron is much lower than the 2017/2018 level. For 65% of iron, the average price in 2020 will decrease to $ 91 per ton, while in 2019, we saw a decrease of about $ 107 per ton. In 2021 and 2022, the decline is projected to reach $ 67 per tonne and $ 65 per tonne, which is significantly lower than the 2018 average of $ 90 per tonne.

Steel is set for moderate performance as advanced economies are expected to slow significantly in 2019, but they should grow moderately by 2020. India will leave the scene in 2020 after a “very weak” leap in 2019, following the announcement of infrastructure developments. He said China, which accounts for 50 percent of global steel consumption, grew significantly in 2019 and the real estate sector exceeded expectations, although less growth may occur in the region by 2020. Attention to investment, fixed assets are weak.

Liao said China’s steel inventory has remained very low, and although profit margins are under pressure due to supply growth, China’s effective steel capacity is still rising. According to the analyst, abroad, the steel market bases in China are weak and in constant demand, which indicates a significant drop in marginal profits.

iron ore pellets market Due to its high quality and reasonable price, it is always hot and prosperous.iron ore locations It always offers the highest quality products.

You can contact us to buy and sell this product:

Sales consultant: Ms. Leila Nematzadeh

Ways of communication: Phone number: 02147623014

Phone number: 02147623014

Phone number: 04133660491

Phone number: 04133660491

Phone number: 09120169267

Phone number: 09120169267

WhatsApp Response (Skype): click

WhatsApp Response (Skype): click

Instagram: simurgh_steel_company@

Instagram: simurgh_steel_company@

email: info@simurghsteelco.com

email: info@simurghsteelco.com

email: ironore110@gmail.com

email: ironore110@gmail.com

Facebook: ironore110@

Facebook: ironore110@

LinkedIn: simurgh-iron-and-steel-company-a68295180@

LinkedIn: simurgh-iron-and-steel-company-a68295180@

twitter: CoSimurgh@

twitter: CoSimurgh@

Call number:

Call number:  Whats app:

Whats app:  Address: Salimi industrial Park, Tabriz, IRI

Address: Salimi industrial Park, Tabriz, IRI Instagram:

Instagram:  email:

email:  Facebook:

Facebook: